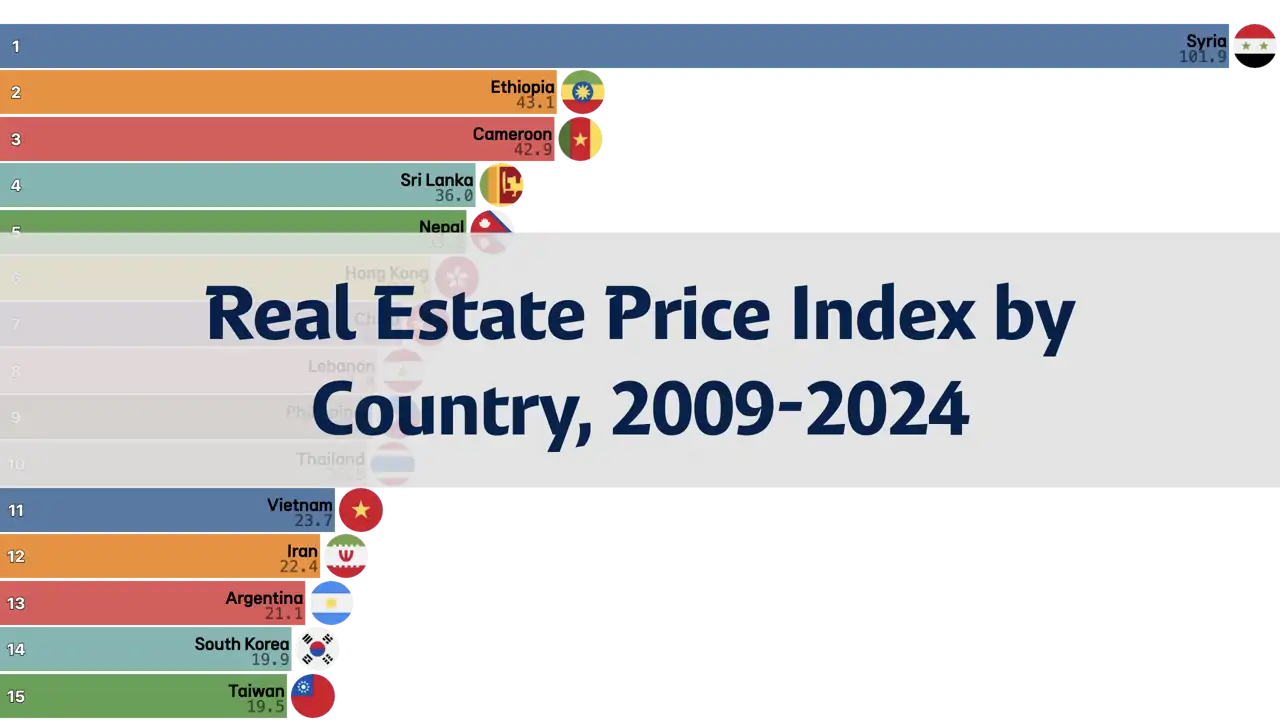

Where in the World Is It Hardest to Buy a Home with the Average Income in 2024?

- ASUMUP

- Economy

- June 10, 2025

Buying a home is a key milestone in many people's lives, but in some parts of the world, it's an almost impossible dream without extraordinary circumstances or generational wealth.

This post looks into a compelling global comparison for 2024: how many years of average income it would take to buy a home in different countries. The higher the number, the less affordable the housing is relative to the average citizen’s earnings.

Interestingly, it's not always the richest countries where housing is most affordable. Factors like income disparity, real estate inflation, and even political instability play a massive role in making housing unattainable in many regions.

From conflict-ridden economies to rapidly urbanizing nations, the reasons behind unaffordability vary greatly. But one common thread among the top entries? The vast chasm between property prices and what people earn.

Let’s dive into the top 10 countries where it takes the longest time to buy a house using the average annual income — and see what makes these markets so inaccessible.

Top 10 Countries Where Buying a Home Feels Impossible

- 1st Syrian Arab Republic – 101.9 years

- 2nd Ethiopia – 43.1 years

- 3rd Cameroon – 42.9 years

- 4th Sri Lanka – 36.0 years

- 5th Nepal – 35.2 years

- 6th Hong Kong (China) – 32.1 years

- 7th China – 29.6 years

- 8th Lebanon – 27.4 years

- 9th Philippines – 27.0 years

- 10th Thailand – 26.5 years

- 100th United States of America – 4.1 years

100th United States of America – 4.1 years

The American housing landscape is heavily influenced by mortgage availability, credit systems, and strong real estate infrastructure. While housing affordability challenges exist in major cities like New York or San Francisco, the national average remains favorable compared to most other countries in this ranking.

10th Thailand – 26.5 years

Despite relatively steady income levels, the average Thai worker finds it difficult to afford property without substantial savings or family support. The government has launched some affordable housing initiatives, but progress is slow.

9th Philippines – 27.0 years

While new condominiums continue to rise, their prices remain out of reach for most local residents. With limited access to affordable housing finance, many turn to informal housing or family arrangements.

8th Lebanon – 27.4 years

Despite a significant drop in real estate transactions, prices have remained high in dollar terms, while average incomes have plummeted. For most Lebanese, buying a home is unattainable unless supported by savings abroad or external financial help.

7th China – 29.6 years

Large cities like Beijing and Shanghai have seen massive real estate speculation, driving prices to levels far beyond average income growth. The government has implemented cooling measures, but homeownership remains a stretch for most young people without family assistance.

6th Hong Kong (China) – 32.1 years

Despite being a high-income city, the property market is dominated by limited land supply and speculative investments. Young people and middle-income earners are often forced to live in cramped 'nano flats' or stay with family well into adulthood. Government intervention has struggled to balance the needs of the population against powerful developer interests.

5th Nepal – 35.2 years

Post-earthquake rebuilding, limited urban planning, and high demand have driven prices to unsustainable levels. Most Nepalis rely on remittances from family members abroad to afford property, making homeownership inaccessible for those without diaspora support.

4th Sri Lanka – 36.0 years

While real estate prices in Colombo and other urban areas have surged due to demand and speculation, wages have lagged significantly. The financial pressures on the average Sri Lankan make homeownership an increasingly distant dream, especially for young professionals and first-time buyers.

3rd Cameroon – 42.9 years

Urban centers like Douala and Yaoundé have housing demand that far exceeds supply. Meanwhile, formal mortgage systems are underdeveloped, forcing many to build incrementally or rely on informal markets. This results in housing insecurity and a lack of long-term planning for millions of residents.

2nd Ethiopia – 43.1 years

Addis Ababa, the capital, has seen property prices soar due to limited housing supply and increasing urban migration. Meanwhile, income growth hasn't kept pace, creating one of the widest affordability gaps in Africa. Rural populations are often entirely priced out of the formal housing market.

1st Syrian Arab Republic – 101.9 years

The housing market in Syria is deeply distorted. While property prices in some areas have stagnated, the value of the local currency and purchasing power have plummeted. For most Syrians, owning a home is not even on the radar — daily survival takes precedence over long-term financial planning. Housing is either inherited, makeshift, or accessed through extended family arrangements.

Other Posts in the Economy

Categories

- National Rankings(43)

- Science & Technology(1)

- Sports(24)

- Economy(30)

- Society(12)

- Culture(7)

Recent Posts

![Bayern Spent HOW MUCH on Harry Kane?! Ranking Their Top 10 Biggest Signings Ever]() A deep dive into Bayern Munich's ten most expensive transfers, exploring how the club's spending strategy has evolved to chase European glory.

A deep dive into Bayern Munich's ten most expensive transfers, exploring how the club's spending strategy has evolved to chase European glory.![Arsenal's Record-Shattering Spree: From a €116M Gamble to a Flop, Who Was Worth the Cash?]() A deep dive into Arsenal's top 10 most expensive signings, analyzing the successes, the failures, and the massive fees that have defined the club's modern transfer strategy.

A deep dive into Arsenal's top 10 most expensive signings, analyzing the successes, the failures, and the massive fees that have defined the club's modern transfer strategy.![Chelsea Cashes In BIG TIME! Who Really Won the 25/26 Summer Transfer Window Money Game?]() A deep dive into the top 10 clubs that made the most money from player sales during the wild 25/26 summer transfer window.

A deep dive into the top 10 clubs that made the most money from player sales during the wild 25/26 summer transfer window.![Liverpool's Record-Breaking €483M Spree! Did They Just Buy the Premier League Title?]() A deep dive into the 25/26 summer transfer window reveals Liverpool's record-breaking spending spree as Premier League clubs continue to dominate the market.

A deep dive into the 25/26 summer transfer window reveals Liverpool's record-breaking spending spree as Premier League clubs continue to dominate the market.![You Won't Believe How Much a Loaf of Bread Costs in These Countries! (Spoiler: It's INSANE)]() This post explores the top 10 countries with the most expensive bread, revealing how factors like import reliance and tourism dramatically inflate the cost of this basic staple.

This post explores the top 10 countries with the most expensive bread, revealing how factors like import reliance and tourism dramatically inflate the cost of this basic staple.